BULLISH

HARAMI: a down body

and a small up body that is completely inside the range of the down body (looks

like a pregnant woman), a prevailing downtrend, the first candlestick is a

normal or long down candlestick, heavy selling, the next candlestick opens

higher or at the close of the former one, signaling a trend reversal since the

second candlestick is small, that the bearish power is diminishing, prices must

cross above the last close for confirmation.

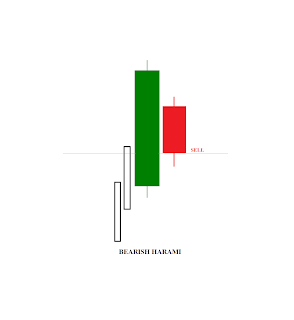

BEARISH

HARAMI: an up body

and a small down body that is completely inside the range of the up body (looks

like a pregnant woman), a prevailing uptrend, the first candlestick is a normal

or a long up candlestick, heavy buying, the next candlestick opens lower or at

the close of the former one, The confirmation level is defined as the last

close or the midpoint of the first white body, whichever is lower. Prices must

cross the last close for confirmation.

BULLISH

HARAMI CROSS: looks

like a pregnant woman, the baby is a Doji, a down candlestick followed by

a Doji that is completely inside the range of the prior down body, the body of

the first candlestick may be short, a bearish mood prevails in the market, a

downtrend is in progress. If the first down body is short, the

confirmation level is the body top of the first candlestick. If the first down

body is not short, the confirmation level will the last close or the midpoint

of the down body of the first candlestick. Prices must cross above these levels

for confirmation.

BEARISH

HARAMI CROSS: looks

like a pregnant woman, the baby is a Doji, an up body followed by a Doji that

is completely inside the range of the prior up body, the body of the first

candlestick may be short, a bullish mood prevails in the market, an uptrend is

in progress. If the first up body is short, the confirmation level is the body

bottom of the first candlestick. If the first up body is not short, the

confirmation level will the last close or the midpoint of the up body of

the first candlestick, prices must cross below these levels for

confirmation.

No comments:

Post a Comment